July/August 2016

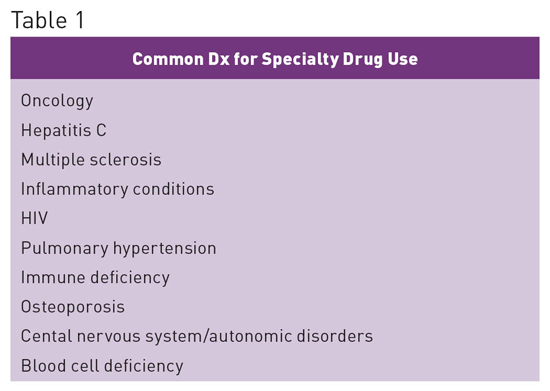

Specialty Drugs: Growing Segment of Pharmacy Spend Specialty drugs represent the fastest-growing segment of pharmacy spend today and have quickly become the major driver of pharmacy costs. This trend is transforming the provision of care across settings and requires health care professionals to increase their awareness and understanding of the benefits and challenges associated with these medications.1 Although there is no industry standard definition for the term "specialty drugs," there are several common elements associated with them, including the following: • typically self-administered, high-cost, injectable or oral drugs; • treat chronic conditions or life-threatening conditions; • many are biologic agents; • require significant patient education, monitoring, and management; • may need special storage and handling; • limited distribution networks (not available from many retail pharmacies); • many require complicated dosing schedules; • side effects can be more frequent and serious than seen with traditional drugs; and • require high levels of adherence to obtain optimal patient outcomes and to prevent waste of financial resources. Benefits vs High Costs

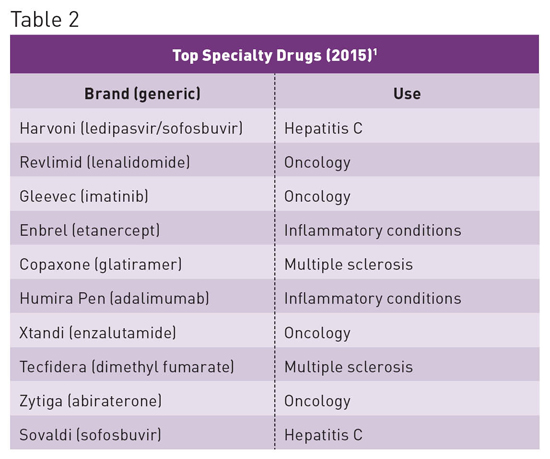

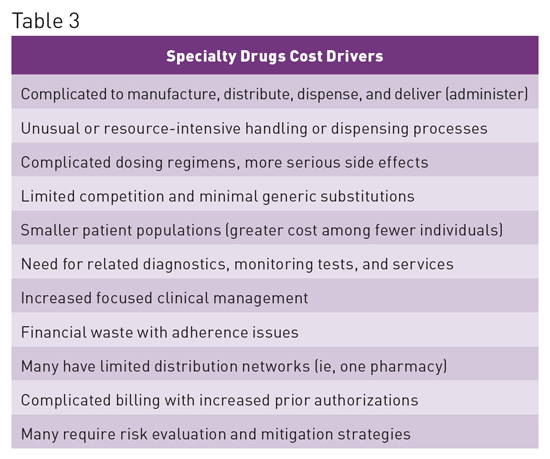

When used appropriately, specialty drugs are extremely effective; however, they cost substantially more than traditional drugs. The specialty drugs Harvoni and Sovaldi have provided a potential cure for the 3 million Americans infected with hepatitis C, but their cost exceeds $1,000 per tablet, resulting in an overall three-month therapy cost of approximately $90,000. Such costs are likely unsustainable and place a tremendous burden on patients, the government, health plans including employers, and the entire US health care system.2 Specialty Drug Spending Trends1 • 37.7% of drug spend is for specialty medications, with the number expected to increase to 50% by 2018. • In 2015 spend increased by 15% to $121 billion. • Spend has doubled in the last five years, contributing 70% of overall medicine spending growth between 2010 and 2015. • Accounts for 36% of nondiscounted medicine spending, up from 24% in 2010. • Increase in spend has primarily been associated with treatments for hepatitis, autoimmune diseases, and oncology. See Table 3 for cost drivers associated with specialty drugs.

In a report prepared by the AARP Public Policy Institute to highlight the impact of drug prices on older adults, it was noted that the average annual retail cost of specialty drugs used to treat complex diseases (eg, cancer, rheumatoid arthritis, and multiple sclerosis) presently exceeds the median US household income. The study, which focused on 115 specialty drugs, found that one year's worth of prescriptions for a single drug retailed at $53,384, on average, in 2013. This represented more than the median US household income, double the median income of Medicare beneficiaries, and more than triple the average Social Security benefit for that year.3 Distribution Challenges Limited Distribution Challenges Some specialty drugs are classified as limited distribution drugs (LDDs) and are available only through a select few specialty pharmacies. In addition to being the only source of LDDs, these pharmacies typically provide an even higher level of clinical expertise around the particular medications they provide, including patient education, service, treatment monitoring, and support.5 The combination of rising cost and distribution challenges can result in a perfect storm, potentially compromising patient care. For example, in 2015 the antiprotozoal medication pyrimethamine (Daraprim) became a single-sourced specialty pharmacy item. As a result, the cost of Daraprim increased by more than 5000%, going from $13.50 to $750 per tablet.6 Additional Challenges for Skilled Nursing Facilities SNFs have been given little guidance as to whether patients admitted to an SNF under Medicare Part A should be permitted to bring and use their home specialty drug supplies. This is complicated because those supplies may have been obtained through Medicare Part D, Medicaid, or other insurance payers. And because of the limited distribution and high costs of many specialty drugs, the specialty pharmacy supplying these medications may be unable to send additional supplies of medication before they are due to be refilled. Without the ability to use a patient's home supply, patients may be unable to be admitted to a nursing center, or if a patient is admitted, he or she could go without necessary medications. SNFs face additional regulatory risk due to requirements for medications to be readily available. For the most part, SNFs utilize one contracted long term care pharmacy with specialized knowledge and expertise in working with long term care centers and patients. The need to obtain many specialty drugs from another pharmacy with additional policies that don't align with those of the SNF can increase the risk of errors and lead to medication availability issues resulting from distribution issues beyond their control. Current regulations fail to address the specific challenges presented by current specialty drug trends, in part due to the rapid growth of the specialty drug market and also due to these medications having previously been used in settings outside of long term care. An illustration of how limited distribution can lead to medication availability issues can be described using pyrimethamine as an example. Prior to becoming a single source LDD, pyrimethamine (Daraprim) was widely available from retail pharmacies. Following the change, institutions such as hospitals could no longer order the medication from the general wholesalers and instead were required to set up an account with the Daraprim Direct program. After enrollment, orders were accepted until 6 PM from Monday through Friday and delivered by the following business workday. Even in the best of circumstances, this made the timely administration of the medication extremely difficult.7 For patients in the community including nursing homes and assisted living facilities, the medication could no longer be obtained from a local retail pharmacy or long term care pharmacy. Instead, all prescriptions now had to be provided by one specialty pharmacy: Walgreens Specialty Pharmacy. Only after insurance verification and copay collection could the prescription be mailed to a patient's home, with most prescriptions being mailed overnight.7 Consideration is required to help ensure supplies are not shipped to a patient's home address but rather to the SNF address. Further delays can occur due to the need to obtain prior authorization approval from payers. Future Needs — Mark D. Coggins, PharmD, CGP, FASCP, is vice president of pharmacy services and medication management for skilled nursing centers operated by Diversicare in nine states and is a director on the board of the American Society of Consultant Pharmacists. He was nationally recognized by the Commission for Certification in Geriatric Pharmacy with the 2010 Excellence in Geriatric Pharmacy Practice Award. References 2. Kirchhoff SM; Congressional Research Service. Specialty drugs: background and policy concerns. https://www.fas.org/sgp/crs/misc/R44132.pdf. Published August 3, 2015. Accessed June 12, 2016. 3. Johnson CY. Specialty drugs now cost more than the median household income. The Washington Post. November 20, 2015. https://www.washingtonpost.com/news/wonk/wp/2015/11/20/specialty-drugs-now-cost-more-than-most-household-incomes/. Accessed June 10, 2016. 4. Distribution dispensing and site of care. Midwest Business Group on Health website. http://www.specialtyrxtoolkit.com/specialty-pharmacy-101/distribution-dispensing-and-delivery. Accessed June 12, 2016. 5. Limited distribution medications. Avella Specialty Pharmacy website. https://www.avella.com/services/limited-distribution-drugs. Accessed June 14, 2016. 6. Beck J. The drug with a 5,000 percent markup. The Atlantic. http://www.theatlantic.com/health/archive/2015/09/daraprim-turing-pharmaceuticals-martin-shkreli/406546/. September 22, 2015. Accessed June 15, 2016. 7. Mahoney MV. New pyrimethamine dispensing program: what pharmacists should know. Pharmacy Times. July 17, 2015. http://www.pharmacytimes.com/contributor/monica-v-golik-mahoney-pharmd-bcps-aq-id/2015/07/new-pyrimethamine-dispensing-program-what-pharmacists-should-know#sthash.GLYKi6pw.dpuf. Accessed June 15, 2016. |